By Brenda Cannon Henley

By Brenda Cannon Henley

Consider this column a Public Service Announcement or PSA from me to my readers. I have been in the newspaper world for many years now and have written my fair share of informative articles about fraud, theft, criminal activity, and those who live to take from those who work hard to pay their just and honest debts. In the past few years, I have interviewed bankers, loan officers, members of the law enforcement departments, and individuals affected by this vastly growing crime. The percentages would frighten the average homeowner or individual.

Never has this information become more relevant to me than this past Saturday morning. I had been to three local stores and was on my way to buy the largest of my weekly purchases — groceries and cleaning supplies that I needed for my home. I hesitate to tell you what happened next because some will not believe me and some will find it humorous, but this is exactly what transpired. As I was coming out of the local post office, a thought shot through my mind, “You might better see what is in your checking account.” Now, some of you, I realize, would not have that problem, but more than a few will identify with why I had the idea that I should check. I quickly hit my credit union button on my really smart phone and pulled up my checking information. The very first two items shocked me.

As I was sitting in the post office parking lot, I saw deductions for over $200 that I had not made or authorized. I quickly glanced down the list of itemized activity and found more. There was not much information on the two lines except the dollar amounts and what appeared to be coded statistics. I could see the words, “skin care,” and some numbers before the over $100 each purchases. I called my credit union immediately and having been a member there for over a decade and a half, I recognized the young lady that answered the phone. I told her what I had found and she said, “Oh, Mrs. Henley, I am so sorry. This stuff is just crazy now. In fact, it is rampant.”

I assured her that I had not made these two purchases, nor had anyone on my behalf, and that no one had my debit card to my knowledge. She took all of the information and put a hold on my card. No one could use it for anything, not even me. The employee assured me that the credit union would get right on it, refund my money to my account, and print me out a new card with the much talked about computer chip included on it. My old card that I had just gotten had the chip, too, and I was just learning how to put it in the bottom of the card readers and leave it until the transaction is complete — unlike we do with the gasoline purchases and others that instruct customers to put the card in and remove quickly.

Now, I also realize that a little over $200 would not matter that much to some readers, but to a one-income household living on a set retirement income, it mattered a lot. In fact, it mattered so much that it made me very angry. Why don’t these clowns get a job and work for their money, like the rest of us do, and stop preying on individuals and accounts that need their money to pay for necessities?

In several conversations with the credit union personnel getting this matter straightened out, I found several more purchases using my debit card that I had not made. We are working on getting them taken care of properly.

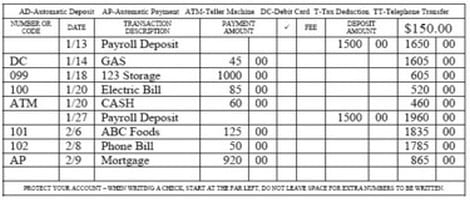

My lesson learned — take time to check those statements, especially if you do online banking and no longer get the printed ones in the mail. Take the time to scan through each item and make sure it is yours and that the figures should be deducted from your money. I found in speaking with several folks who know much more about this than I do that they now believe at least one third of all accounts for credit unions and banks will have instances of fraud within the year. Think about that figure. Over 33 percent will have the same problem I did or much worse. Thank God, I did not have to cancel all of my cards, get a new license, or other time consuming and aggravating issues that occur when a wallet or purse is stolen.

These same savvy folks believe that the new cards with the computer chips will help to deter this type of fraud and theft, but only when the machines or terminals are set up and are functioning properly in each location. The kind lady I was dealing with at the credit union had just experienced a similar affront to her own card with someone claiming to be a part of a major company.

Be alert and be very careful to keep a check on your business affairs.

[3-7-2016]

Brenda Cannon Henley can be reached at (409) 781-8788 or,

[email protected]

Posted in

Posted in

Brenda! What a disaster! That is a new one on me! I will surely pass this along to others!!

We are enjoying our new life “living” up near Dallas but miss my family that is there on Bolivar Peninsula and also our friends there! Family up here is taking good care of us and we see many of them often as some live live close by…

Getting older is not for the faint of heart.. and we have had some health “issues” but none real serious…. Our 1.5 acres is heavily wooded , which we think is great… (EXCEPT when the leaves all started to fall and then there were millions of leaves to rake up and burn…) We have put in some “grow boxes”, ( Ed built) , waist high, for our Spring garden! with flower boxes on one unit… Looks so much like Spring and I hope it is is here to stay… My red bud tree is in full bloom and some white beauty ,that did not bloom last year,(?) look so fine mixed with the oak and cedar trees that shade our entire property… . God is good! Still look forward to reading your articles in the Bolivar News… Keep up the good work! Sincerely… Barbara Prengere